🗓️ Update — October 2025: Airbnb Postpones Texas Data Processing Tax Collection

Airbnb has announced that the previously planned Texas Data Processing Tax—which was set to begin in October 2025—has been postponed until further notice.

“The collection and remittance of this tax will be postponed until further notice. There is no action required by you. Once more guidance is provided by the Texas tax authorities, we will notify you.” — Airbnb Team

💡 What This Means

-

No immediate changes to owner payouts, nightly rates, or guest charges.

-

No new taxes will appear on Airbnb receipts or checkout pages for now.

-

No action required from owners, hosts, or StellarStay.

We’ll continue to monitor updates from Airbnb and the Texas Comptroller’s Office and will notify our partners once a new implementation timeline is confirmed.

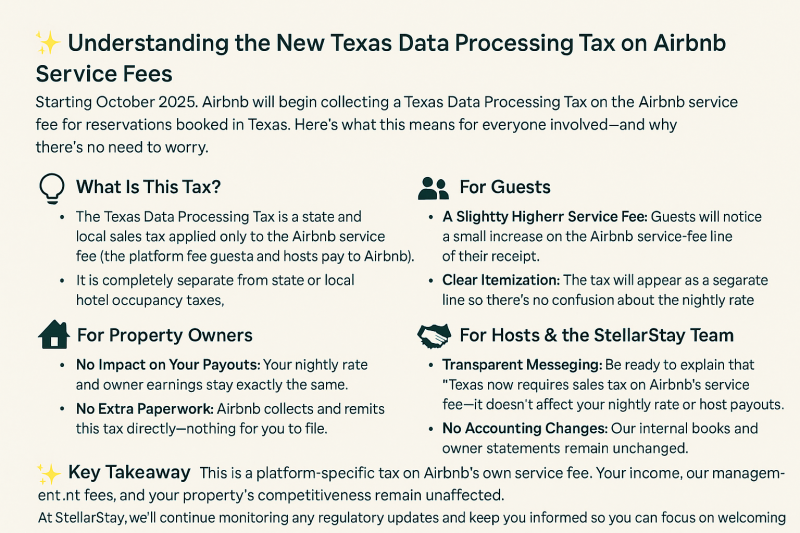

🌟 Understanding the New Texas Data Processing Tax on Airbnb Service Fees

Originally planned for October 2025, Airbnb announced that it would begin collecting a Texas Data Processing Tax on the Airbnb service fee for reservations booked in Texas. Here’s what this means for everyone involved—and why there’s no need to worry.

💡 What Is This Tax?

The Texas Data Processing Tax is a state and local sales tax applied only to the Airbnb service fee (the platform fee guests and hosts pay to Airbnb).

It is completely separate from state or local hotel occupancy taxes.

🏡 For Property Owners

-

No Impact on Your Payouts: Your nightly rate and owner earnings stay exactly the same.

-

No Extra Paperwork: Airbnb collects and remits this tax directly—nothing for you to file.

👥 For Guests

-

A Slightly Higher Service Fee: Guests will notice a small increase on the Airbnb service-fee line of their receipt.

-

Clear Itemization: The tax will appear as a separate line so there’s no confusion about the nightly rate.

🤝 For Hosts

-

Transparent Messaging: Be ready to explain that “Texas now requires sales tax on Airbnb’s service fee—it doesn’t affect your nightly rate or host payouts.”

-

No Accounting Changes: Our internal books and owner statements remain unchanged.

-

Guest Support Ready: We’ll add a quick FAQ response so our team can answer guest questions instantly.

✨ Key Takeaway

This is a platform-specific tax on Airbnb’s own service fee.

Your income, our management fees, and your property’s competitiveness remain unaffected.

At StellarStay, we’ll continue monitoring any regulatory updates and keep you informed so you can focus on welcoming happy guests.